The availability has increased due to both high volume of new Moscow retail supply (560,000 sq m* in 2015) and active rotation of tenants who are under pressure due to sagging consumer demand.

According to Rosstat, accumulated retail turnover growth in January-November in Russia has reached a level of -9.3% to the corresponding period of the previous year, Moscow’s retail sales were down by 13% YoY over the same period.

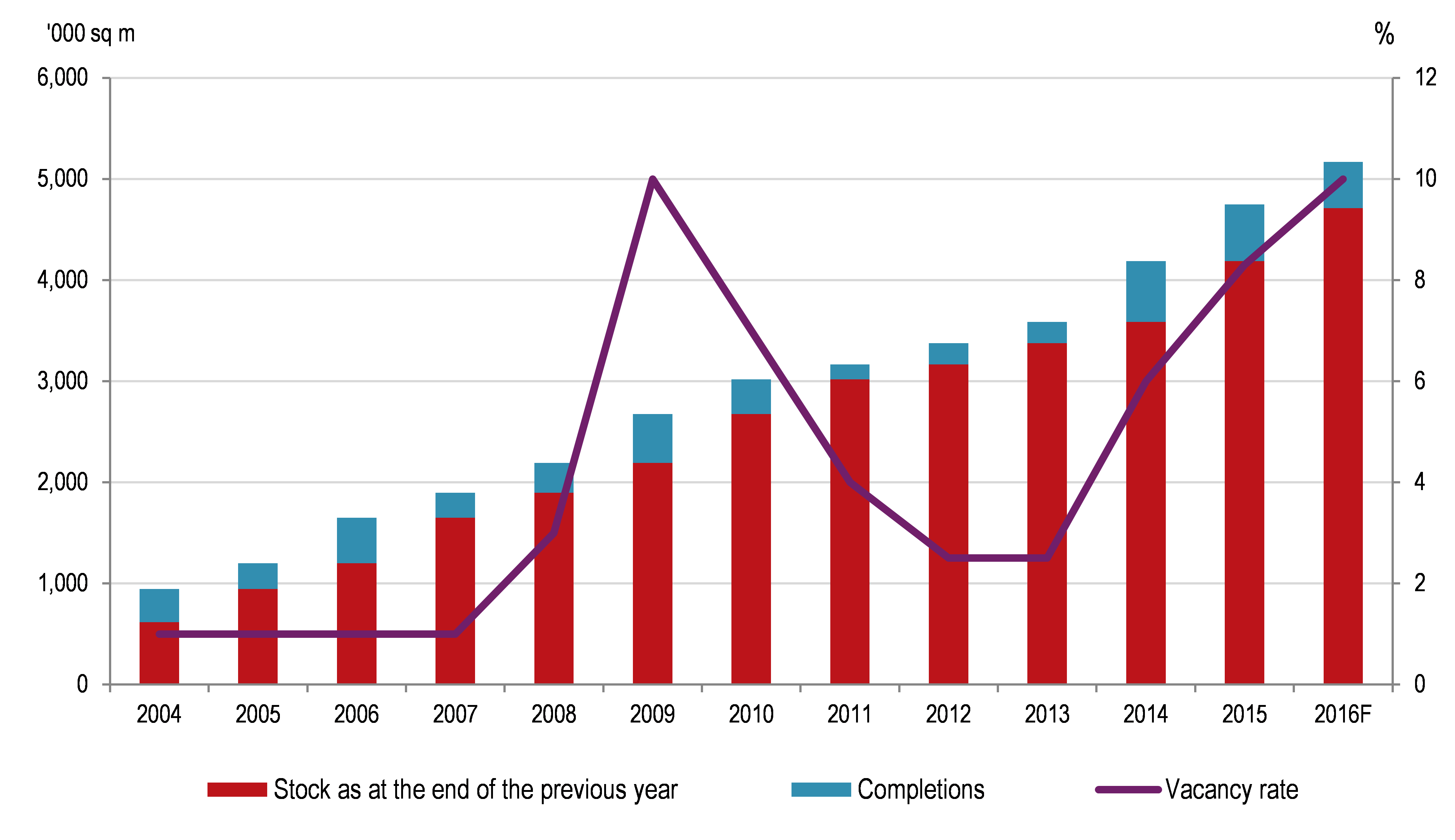

JLL estimates that the vacancy rate on Moscow shopping centre market might reach 10% by the end of 2016, which is close to the record-breaking 11% of Q2 2010. “The reasons for the expected growth of vacancy rate in Moscow shopping centres are the negative forecast for retail market dynamics as well as a significant volume of new projects launched their development before the crisis,” – Tatyana Kluchinskaya, National Director, Head of Retail Department, JLL, Russia & CIS, explains. – “Around 460,000 sq m of new quality shopping centres is likely to be completed in Moscow this year, and following the latest market trends, they are to be occupied by average 50-60%”.

“Currently, expansion-oriented retailers enjoy a variety of alternative offers in the existing shopping centres and prefer the malls with clear footfall and predictable sales. The empty spaces of newly-established schemes will be rented out gradually during the first year of operation. In addition, the significant decline in the future supply will support the overall vacancy rate’s contraction in the market in the long term.” – Tatyana Kluchinskaya adds.

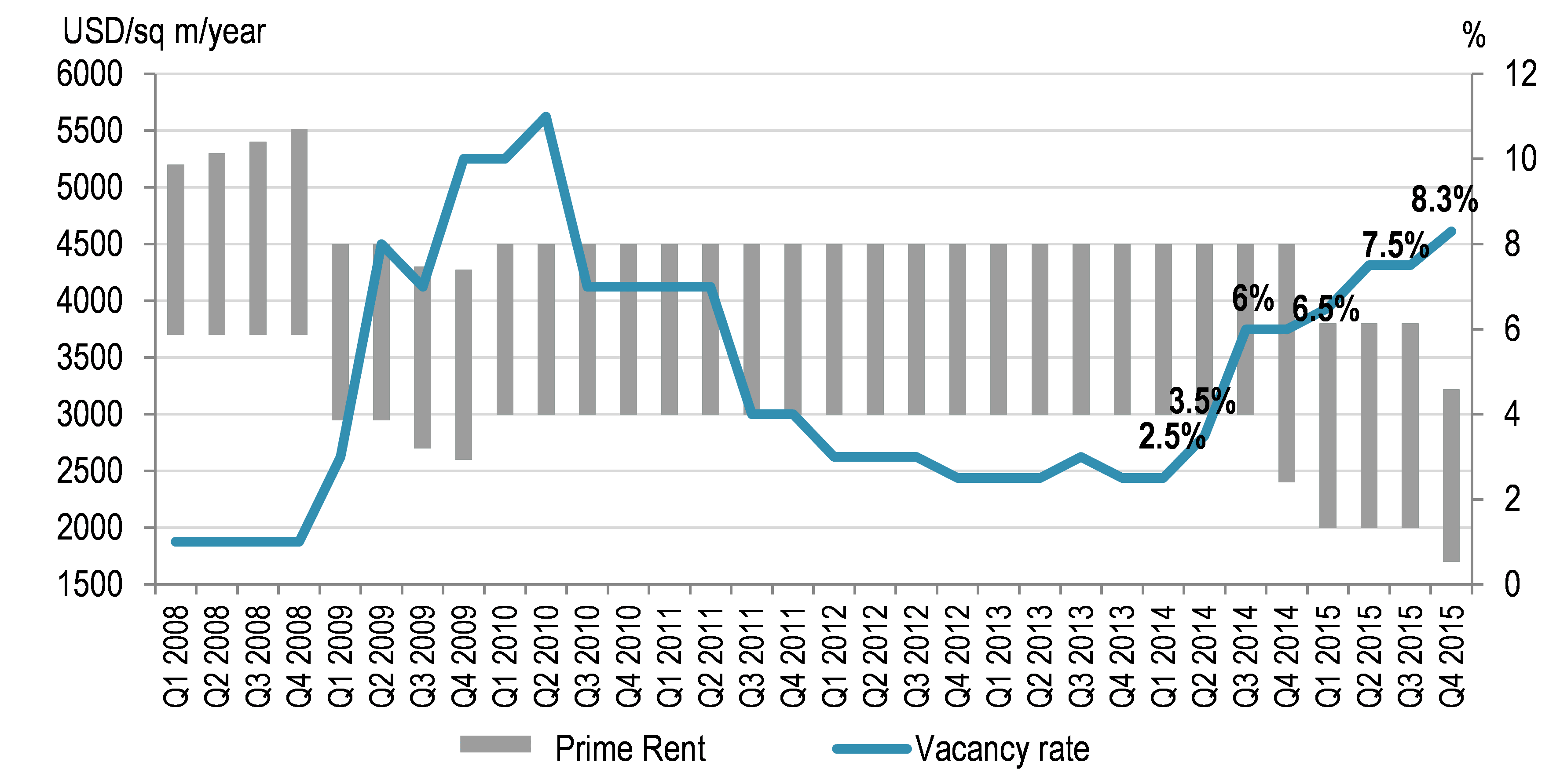

The rents for Moscow shopping centres have declined by 15% in Q4 2015. Today, prime rents for shopping gallery stand between USD1,700-3,220/sq m/year, average rents account for USD300-1,200. JLL experts do not expect any improvements in these indicators against a backdrop of weak economy in 2016.

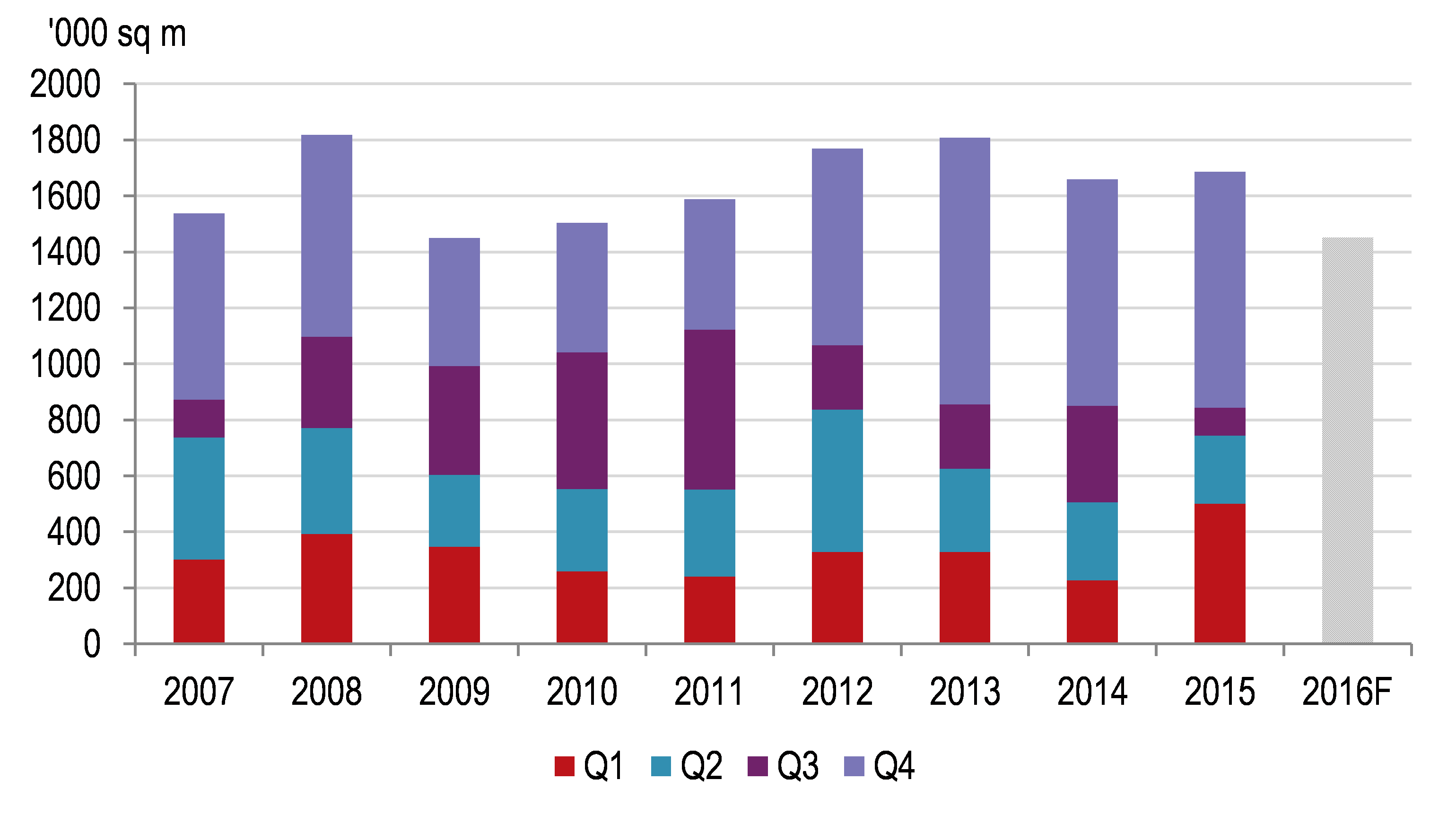

The volume of new shopping centres supply for 2015 equals to 1.68m sq m, with 843,000 sq m in Q4 2015 (growth of 1.7% and 4.2% on YoY basis respectively). As a result, retail market volume stands at 19.3m sq m in 2015. The cities with a population below 500k people and Moscow constituted the largest shares of new shopping centres deliveries (40% and 33% respectively). According to JLL expectations, shopping centre completions in Russia are likely to decrease in 2016 to 1.4m sq m.

“The average level of shopping centres’ occupancy is less in the regions than in Moscow. As a rule, a list of tenants in newly-opened regional shopping centres includes only a food retailer chain, a children’s store, and a fashion discount brand. The major challenges of landlords are connected with fashion gallery’s occupancy, as many domestic and foreign retailers are optimizing their portfolios, and absolute majority of expansive players are focusing on Moscow and St. Petersburg.” – Maria Shpakova, Retail Market Analyst, JLL, Russia & CIS, notes.

Comments

Add comment