The Federal Reserve is preparing to raise interest rates, the price of oil – Russia’s lifeblood – has dropped back below $50 a barrel and the U.S. election is just days away. Even history is against Russia’s currency, which has weakened from November through December in four of the past five years.

Yet none of this is discouraging investors such as Ashmore Plc and Landesbank Berlin, which recommend hanging on to ruble assets for their relatively high yields. Russian Central Bank Governor Elvira Nabiullina’s September pledge to keep local rates at 10 percent have boosted so-called carry trades in the ruble, and forecasts suggest these deals, where speculators borrow cheaply to buy higher-yielding assets, will offer the world’s second-best returns through 2017.

“What are the sellers going to buy in this environment after selling ruble assets?” said Lutz Roehmeyer at Landesbank Berlin Investment, who helps oversee $12 billion from the German capital. “It’s not wise to sell, because ruble bonds still pay a nice carry,” he said, adding that investors should adopt a “buying-on-dips mentality.”

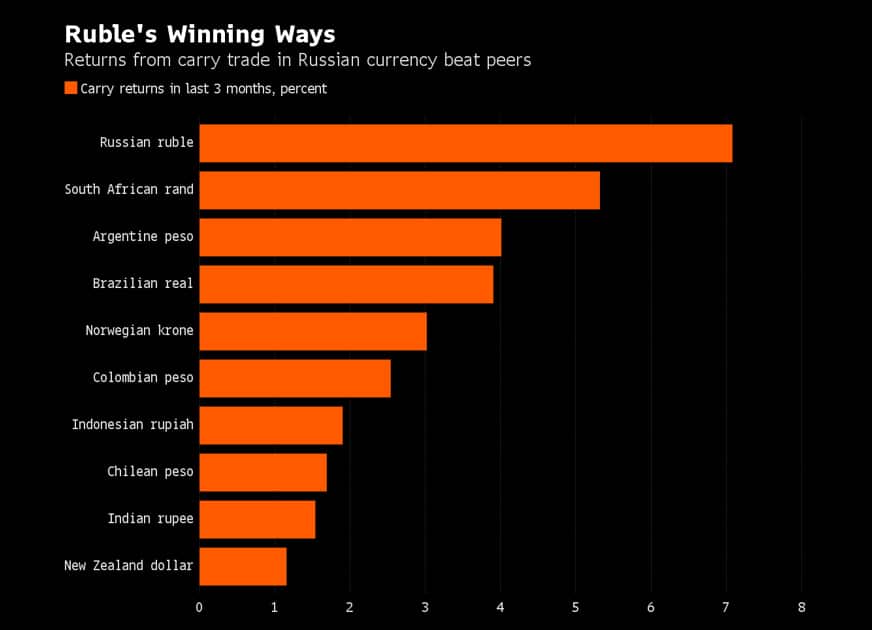

Borrowing dollars at close to zero percent to buy assets denominated in the Russian currency has handed investors almost 7 percent in the past three months, the most among 31 major currencies. The trades will more than double that gain by the end of next year by returning 15 percent, second only to investing in Argentina’s peso, according to forecasts compiled by Bloomberg.

Citigroup Inc., the biggest foreign-exchange trader, has said Russia is engineering a “super-carry” currency, while Goldman Sachs Group Inc. called the ruble one of its “most-favored carry candidates.”

With central banks across the developing world still committed to cheap money to spur their lackluster economies, the number of assets yielding less than zero is increasing, encouraging money managers to snap up higher yields where they find them.

The ruble has climbed since reaching a record low of 85.999 per dollar in January, and was at about 63.7 in Moscow on Thursday – up 16 percent this year and on course for its first annual advance since 2012. Sixty percent of 20 analysts in a Bloomberg survey said they don’t expect a correction in Russia’s currency before the year is out.

“The market is yield-hungry,” said Tom Levinson, senior foreign-exchange and interest-rate strategist in Moscow at Sberbank CIB, the investment-banking arm of Russia’s largest lender and the second most-accurate ruble forecaster in Bloomberg’s latest rankings. It sees the currency climbing toward 61 per dollar by year-end. “As long as global volatility stays benign, then these trades can remain popular.”

With net bets on a stronger ruble having surged to a record, the potential for a sharp unwind of speculative positions — accompanied by a drop in the currency – is intensifying.

Hedge funds have almost tripled net-long ruble wagers to an all-time high of 32,339 futures contracts since September, when Nabiullina made her unprecedented promise to keep interest rates unchanged into 2017 and OPEC reached an agreement to limit output and prop up oil prices.

The impact of the deal proved short-lived, though, and Brent crude has been falling for the past two weeks in a blow to the main source of Russia’s export revenue. Signs that Republican Donald Trump is closing on Hillary Clinton in the race for the White House is seen by most observers as bad for emerging-market assets, and futures imply a 78 percent chance of a dollar-boosting hike to U.S. rates this year.

These risks, though, are “temporary” and investors should still “buy the ruble into the year-end,” said Jan Dehn, head of research at London-based Ashmore, which oversees $54 billion of emerging-market assets. “I don’t expect strong directional movements this year barring major surprises, but I expect the ruble to gradually appreciate against a backdrop of a weaker dollar next year.”

Comments

Add comment