Russia, a leading exporter of crude oil for decades now, is increasingly dominating another critical global commodity. Its output of wheat has surged in recent years as good growing conditions boost farmers’ profits, allowing them to reinvest in better seeds and equipment. As low oil prices hurt the ruble, making grain more alluring for overseas buyers, Russia grabbed more of the wheat-export market from major shippers like the U.S. This is particularly welcome news for Russia as it tries to cut its dependence on agricultural imports, after it banned imports of some western foods in retaliation to sanctions imposed over the annexation of Crimea.

About half the countries in the world import wheat from Russia. Some of the biggest buyers are situated a short distance away, in the Middle East and North Africa, but demand comes from as far away as Mexico and Indonesia. Russia’s top customer, Egypt, depends on Russian wheat to feed its people, while No. 2 buyer Turkey uses the grain to make flour it then exports. This season’s shipments are expected to be up more than 40 percent from just three years ago.

It’s cheap. Gluts from years of bumper harvests depressed prices, which are also kept down by the short shipping routes from the Black Sea — the hub for the bulk of Russia’s supply — to Middle Eastern and African buyers. More recently, poor crops made grain from North America and Australia less attractive to some of their traditional markets in Asia, opening up the door for Russian wheat.

Russia’s wheat exports began to surge at the start of this century, after Soviet-era collective farms gave way to private ownership of rich soils and farmers gained access to the latest international technology. Now, tractors made by U.S. firm Deere & Co. and Germany’s Claas KGaA roll across Russian farms, and crops are sprayed with pesticides made by Monsanto Co. and Syngenta AG. Helped by state support, farmers’ costs can be as little as half those of major competitors, so Russia can afford to keep planting even when prices tumble.

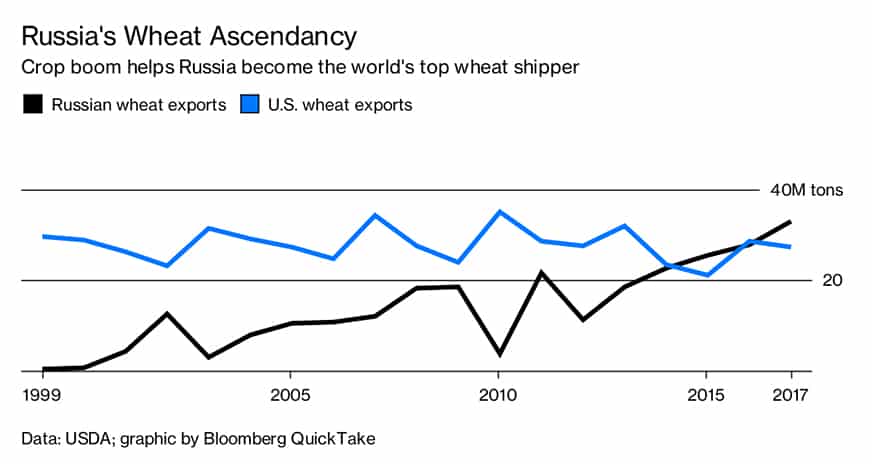

Now forecast as the top wheat shipper, Russia saw its share of the export market jump from less than 1 percent in 2000 to an estimated 18 percent this season. During the same period, the U.S. share was cut almost in half. Bigger Russian harvests have added to the global glut and pushed prices in Chicago to near a decade low, prompting American farmers to plant the least winter wheat in a century last year. Russia’s dominance also gives it the power to shake up world markets. Benchmark prices surged almost 50 percent in 2010 as Russia banned exports, following a drought.

Harvests may keep setting records — weather permitting — but there are signs the country’s ports and railways are starting to creak under the pressure of so many exports. Plus, Russia has struggled to crack some markets. Russian grain typically doesn’t meet strict quality requirements set by key buyers Algeria and Saudi Arabia, for example, and it’s cheaper for Brazil to buy from suppliers within the Mercosur free-trade bloc. Russia has made inroads in Asia, but high shipping costs will likely limit how much it sends there.

Transforming its farm industry will still leave Russia a long way from competing in the global corn, sugar or meat markets in the way it does with wheat. It’s now self-sufficient in producing sugar, but output costs are too high for large-scale exporting. Plus, Russia isn’t equipped to adequately handle shipments in containers, the world’s preferred way to haul white sugar. The nation struggles to compete in corn because the government bans genetically modified seeds that make growing the crop more profitable in other countries. Widespread African swine fever in Russia’s agricultural regions prevents significant pork exports.

Comments

Add comment